Originally posted by Denny

View Post

Announcement

Collapse

No announcement yet.

25 year depression coming soon

Collapse

X

-

I have heard from several folks in the business that $60 is where it starts getting interesting and $50 means the shit really hits the fan.Originally posted by racrguyWhat's your beef with NPR, because their listeners are typically more informed than others?Originally posted by racrguyVoting is a constitutional right, overthrowing the government isn't.

-

It's field to field. Not every play has the same break even point.Originally posted by Denny View PostI heard ~$60 is the breaking point for a lot of smaller outfits. If that's true, that's a hell of a gap from $40. I do know that Halliburton has still been hiring like crazy.ZOMBIE REAGAN FOR PRESIDENT 2016!!! heh

Comment

-

This.Originally posted by YALE View PostIt's field to field. Not every play has the same break even point.

Right now even the Eagle Ford is looking less appealing, and that area supposedly has an average wellhead breakeven of somewhere between $50-65/bbl, depending on who you look at.

A week or two ago Pioneer sold off a big pipeline in south TX "in order to continue operating efforts in the Permian." Their CEO is expecting $70-80/bbl for the next 1-2 years. Analysts I've met and listened to agree with that.

Historically, Permian is the safe play for everyone, but even it's not completely immune. Average wellhead breakevens in the past couple months:

Permian Midland ~$48/bbl

Permian Delaware ~$52/bbl

Permian Wolfcamp ~$60

Permian Yeso ~$62

Permian Central Basin ~$70-75

Permian Wolfbone ~$71

Permian Bone Spring ~$73

Permian Cline Shale ~$77

Permian Sprayberry ~$91

The number of US O&G well permits issued dropped 37% from October to November (new permits are a good indicator of drilling activity in the next 60-90 days).

Permits by major play for November

Permian Basin: -38%

Eagle Ford: -28%

Bakken: -29%

I know the E&P end of the spectrum would like $80. Around 2/3 of the US shale plays are still viable at that point.Originally posted by Broncojohnny View PostI have heard from several folks in the business that $60 is where it starts getting interesting and $50 means the shit really hits the fan.

Fundamentally we need to either start exporting crude or cut production (we're getting into a large oversupply in the next 2 yrs), and that's going to happen by changing laws or pricies falling through the floor. This is one way to do it, but I'm sure most people would rather keep higher prices and start sending excess out of our borders.

Comment

-

Oil prices are signaling something for sure. The fed has created the biggest market bubble in history. Interest rates will eventually begin to rise and the party will end.Originally posted by Broncojohnny View PostIf you read the comments from some of the Fed regional heads, they are supposedly going to raise rates once and then see how the markets react. Last time they starting raising rates, they did it 17 straight times. They can't do that this time.

What I have to laugh at is the eternal stock market pumpers. The Jim Cramer types of the world who insist that everything is a buy signal. Right now they are touting the drop in oil prices as a huge positive for the economy while simultaneously saying the Fed should delay raising rates because of it. Hilarious.

Comment

-

When I interviewed on Nov 1st with a company that supports drill rigs/companies, I specifically asked that question. "At what price per barrel does this company start to feel the squeeze?"Originally posted by Broncojohnny View PostI have heard from several folks in the business that $60 is where it starts getting interesting and $50 means the shit really hits the fan.

He said that he wouldn't see any drop in work unless prices got into the $40's. Of course I am still unemployed even though he has said numerous times over the past month they want to hire me. Yesterday it came out "hiring freeze until we know what is going to happen with these priced".

So looks like I found out the truth. The squeeze is in the $70's.Fuck you. We're going to Costco.

Comment

-

Not all of them. Saudi Arabia has always kind of had one foot out the door, depending on conditions. The rest of OPEC wants them to cut production right now, but they're comfortable where things are at.Originally posted by QIK46 View PostOpec is playing a game to see who folds first with the low oil prices. They figure if they oversupply the market they can put the squeeze on US producers. The real question is who gives in first.ZOMBIE REAGAN FOR PRESIDENT 2016!!! heh

Comment

-

Basically.Originally posted by QIK46 View PostOpec is playing a game to see who folds first with the low oil prices. They figure if they oversupply the market they can put the squeeze on US producers. The real question is who gives in first.

“We are entering a new era for oil prices, where the market itself will manage supply, no longer Saudi Arabia and OPEC. It’s huge. This is a signal that they’re throwing in the towel. The markets have changed for many years to come.â€

- Mike Wittner, the head of oil research at Societe Generale SA in New York

"OPEC has chosen to abdicate its role as a swing producer, leaving it to the market to decide what the oil price should be.â€

- Harry Tchilinguirian, head of commodity markets at BNP Paribas SA in London

“OPEC’s decision means it is over to you America. This opens the window for the U.S. to be the new swing producer.â€

- Miswin Mahesh, a London-based commodities analyst at Barclays Plc

Exactly. Saudi is striking out on their own a bit on this.Originally posted by YaleNot all of them. Saudi Arabia has always kind of had one foot out the door, depending on conditions. The rest of OPEC wants them to cut production right now, but they're comfortable where things are at.

"OPEC will face pressure too, with prices now below the level needed by nine member states to balance their budgets, according to data compiled by Bloomberg."

Comment

-

I'm thinking the saudis have the lowest cost of production, so what they are saying is that the US can be the swing producer at $60 a barrel. The swing being a big cut to current volume.Originally posted by racrguyWhat's your beef with NPR, because their listeners are typically more informed than others?Originally posted by racrguyVoting is a constitutional right, overthrowing the government isn't.

Comment

-

Just making wild-ass assumptions and spitballing here, but what if Saudi Arabia is in the process of shitting the bed?

They're super tight-lipped about their fields; most of the info on the health of their fields is gathered by inference and guessing... and the very-smart-people inferences are based on the fact that the Saudis don't even really try to hide the fact that they misreport their resources (in their favor, of course)Originally posted by Broncojohnny View PostI'm thinking the saudis have the lowest cost of production, so what they are saying is that the US can be the swing producer at $60 a barrel. The swing being a big cut to current volume.

But the general consensus is that they are ok down to like $20/bbl. I would ignore the Y axis label here and just pay attention to the scale between each region.

Saudi also has shit reporting on the health of the Ghawar field, so does anyone really know what's going on over there and what's driving this? They're using secondary recovery techniques (waterflood) and there have been rumors for a while that they are not in such a good place as they have been reporting. Hell 10 years ago there were predictions that the Saudis were headed to a bad place with the Ghawar. Supposedly they are getting 30-55% water cut in their production. Dealing with all that water costs money and will quickly make a field a giant pain in the ass... and some of the solutions they were looking at using in the early 2000s (downhole pumps) risk damaging the field severely (happened in Russia).

Simmons International is an energy (O&G) centered independent investment bank. I get regular updates from them on the state of the industry and from what I know and have seen they really know their shit. They've been predicting this for a while.

From 2004:

Matt Simmons (of Simmons International) wrote a book in 2006 called Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy"It seems a growing number of analysts are falling into line with the Simmons & Company International view that Saudi Arabia may be running out of steam and may not be able to perform the role of global swing producer for many more years, despite being credited with oil reserves in the order of 260 billion barrels. The Centre for Global Energy Studies hinted at the beginning of the year that the kingdom appeared to be heading for difficulties. Now one of its analysts has said that having reserves does not equate to production capacity. Citing the Haradh field, he said it required 500,000 barrels per day of water injection to get out 300,000 bpd of oil. Moreover the problem is even more serious in the Khurais field." "Doubts grow about Saudi As Global Swing Producer,"

What if they aren't playing chicken here, but are actually bowing out of the power position for real?

They've said they can churn out 12 million bbl/day if needed, but that's never happened.

Here's are bits and pieces from another prediction 10 years ago:

2004:

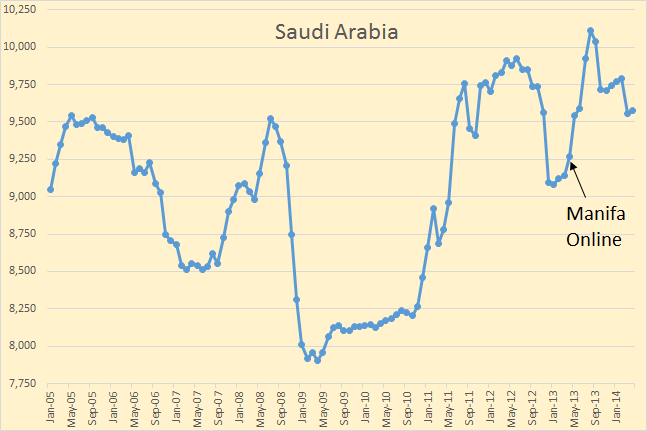

They never got to 12 mmbpd, but is that b/c of the US shale oil on the market or because they just can't do it anymore? That Manifa field (discovered in the 50s then put on the back burner) brought online was their last play as far as I know. They haven't had great exploration success since the 1960s.Forecast of Rising Oil Demand Challenges Tired Saudi Fields

Outsiders have not had access to detailed production data from Saudi Aramco, the state-owned oil company, for more than 20 years. But interviews in recent months with experts on Saudi oil fields provided a rare look inside the business and suggested looming problems.

Saudi Arabia, the leading exporter for three decades, is not running out of oil. Industry officials are finding, however, that it is becoming more difficult or expensive to extract it.

Saudi Aramco says its dominance in world oil markets will grow because, "if required," it can expand its capacity to 12 million barrels a day or more by "making necessary investments," according to written responses to questions submitted by The New York Times.

But some experts are skeptical. Edward O. Price Jr., a former top Saudi Aramco and Chevron executive and a leading United States government adviser, says he believes that Saudi Arabia can pump up to 12 million barrels a day "for a few years." But "the world should not expect more from the Saudis," he said

Fatih Birol, the chief economist for the International Energy Agency, said the Saudis would not be able to increase production enough for future needs without large-scale foreign investment.

Publicly, Saudi oil executives express optimism about the future of their industry. Some economists are equally optimistic that if oil prices rise high enough, advanced recovery techniques will be applied, averting supply problems.

But privately, some Saudi oil officials are less sanguine.

"We don't see us as the ones making sure the oil is there for the rest of the world," one senior executive said in an interview. A Saudi Aramco official cautioned that even the attempt to get up to 12 million barrels a day would "wreak havoc within a decade," by causing damage to the oil fields.

Seriously, 10 years ago there were a lot of predictions that Middle East oil had about a decade left on top of the market before it lost its power.

2004:

"The Wocap simulations for Saudi oil are presented in Fig. 5. They clearly show a long plateau at 8-10 million b/d. Here the main question is: How long can Saudi Arabia plateau at that level? Or in other words: Will it age gracefully? Much will depend on Ghawar. “

“With 100 billion bbl of crude oil produced so far, Saudi Arabia should not be far from the midway point of its proved reserves of 260 billion bbl—that means just 10 years at the going rate of roughly 3 billion bbl/year. Bearing in mind the "spurious revision" of 1990 that boosted proved Saudi reserves to 257. billion bbl from 170 billion bbl, the midway point could happen even sooner than that. “

“Furthermore, the 35 billion bbl produced during 1990-2002 has not been accounted for, as Saudi "proved reserves" were still being reported at 260 billion bbl by the close of 2001.Last edited by Strychnine; 12-03-2014, 12:06 PM.

Comment

-

So how does all of that play into them pumping the shit out of it? Or do you feel this is a demand problem?

Btw, there is an article up on zerohedge offering up the idea that O&G has provided 93% of the jobs gained back since 2008.Originally posted by racrguyWhat's your beef with NPR, because their listeners are typically more informed than others?Originally posted by racrguyVoting is a constitutional right, overthrowing the government isn't.

Comment

-

Yeah, they are pumping the shit out of it, but it's not as easy to get the same output as in the past.Originally posted by Broncojohnny View PostSo how does all of that play into them pumping the shit out of it?

Compare Saudi output to rig count. Generally this blue block is in the same range (8-11 mm bbl/d) over 8 years,but look at the jump in rig count (black line) over that period. From 2005-2007 there was a doubling of the fleet, but production numbers didn't exactly follow.

C+C+NGL = crude + condensate + natural gas liquids

Finally, it is worth taking a look at Saudi Arabia (Figure 7). The number of rigs operating in the Kingdom reached a record high of 88 in October 2012 and there has to be a message in that statistic in itself. The split was 58 oil and 30 gas. But Saudi Arabia continues to produce around 11.7 million bpd on a slowly rising bumpy plateau with a relatively tiny number of operational rigs. The production world changed in Saudi Arabia in 2005 when the drilling rig count more than doubled, drilling new wells to combat declines from legacy assets like Ghawar.

You can look at a similar graph for the US, but we have new resources coming online all the damn time. Saudi has fields from the early to mid 1900s full of water.

(or maybe i misunderstood the question)Last edited by Strychnine; 12-03-2014, 05:06 PM.

Comment

Comment