Announcement

Collapse

No announcement yet.

And there was much rejoicing in the land.... Gas Prices

Collapse

X

-

-

Anyone want to buy an E&P?

Whiting Petroleum Seeks Buyer Amid Plunge in Crude Prices

Denver-based company is in midst of auction process, people familiar with the matter say

March 6, 2015 8:03 p.m. ET

Whiting Petroleum Corp. is seeking a buyer after plummeting crude prices took a bite out of the oil-and-gas producer’s results and its shares tumbled.

The company, which has an equity value of $5.8 billion, is in the midst of an auction process, according to people familiar with the matter. It is unclear who may be interested in buying the company and there is no guarantee it will be sold.

Denver-based Whiting, one of the largest producers in the prolific Bakken Shale formation in North Dakota, is suffering from the sharp decline in oil prices just as it begins the process of swallowing rival Kodiak Oil & Gas Corp. The $3.8 billion deal, which closed in December, saddled the company with more than $2 billion of additional debt; Whiting now has a so-called enterprise value, which includes debt, of more than $11 billion, according to S&P Capital IQ.

The company’s increased exposure to declining energy prices and heavy debt load have taken a toll on its shares, which are down more than 60% from their high last summer. Whiting isn't the only oil producer buffeted by the sharp drop in the price of crude, and it is not the only one seeking a buyer either. Penn Virginia Corp. , which drills for oil and gas in Texas, Oklahoma and Pennsylvania, is exploring a sale after its stock declined and its reserves lost value, The Wall Street Journal recently reported.

Whiting was founded in 1980 by Kenneth R. Whiting and Bert Ladd. The company went public in 1983 before a utility company acquired it in 1992. Whiting then returned to public ownership in 2003.

On Feb. 25, Whiting reported a roughly 3% decline in revenue in the fourth quarter to $696.1 million, and a $353.7 million loss. The company also said it would slash its capital budget to $2 billion for 2015. The results, which missed analysts’ expectations, were buffeted by $587 million in pretax impairment charges related to properties not being developed because of falling oil-and-gas prices, Whiting said.

Whiting considered selling itself in 2012 but ultimately decided not to proceed after buyers balked over the asking price, people familiar with the matter said at the time.

And in other news:

ISIS Beheads 8 Oil Workers In Libya

Libya's military spokesman, Ahmed al-Mesari, said Monday that militants from the country's ISIS affiliate have beheaded eight guards following an attack on the al-Gani oilfield last week, during which nine foreigners were also kidnapped. Al-Mesari also told the media than an employee at the al-Ghani oil field witnessed the beheadings and died soon thereafter as a result of cardiac arrest.

Al-Mesari did not explain how the army gained knowledge of the beheadings, but the personnel serving as oil guards are closed linked to the Libyan military, which reports to the eastern-based, internationally recognized Libyan government.

Comment

-

Fuck, as if you didn't have enough to worry about ISIS beheading you, you die of a heart attack seeing the shit happen...Originally posted by SilverbackLook all you want, she can't find anyone else who treats her as bad as I do, and I keep her self esteem so low, she wouldn't think twice about going anywhere else.

Comment

-

Been meaning to ask how it's going but haven't had a minute to myself lately. Hate to hear that man. Let me know when your next day(s) off are.Originally posted by kbscobravert View PostWell, the crew I am on just got put in the yard. Good thing about that is, no more Pecos for a while. Bad thing, no guaranty for work out of the yard in the near future. No way can I last at 45 hours a week in the yard for more than a week or two.

David

Comment

-

Sorry to hear it. It seems like I am hearing that every other day now.Originally posted by kbscobravert View PostWell, the crew I am on just got put in the yard. Good thing about that is, no more Pecos for a while. Bad thing, no guaranty for work out of the yard in the near future. No way can I last at 45 hours a week in the yard for more than a week or two.

Comment

-

New production high and another 4 million barrels in the tanks. Keep on pumping as long as you can borrow the capital!Originally posted by racrguyWhat's your beef with NPR, because their listeners are typically more informed than others?Originally posted by racrguyVoting is a constitutional right, overthrowing the government isn't.

Comment

-

Originally posted by Broncojohnny View PostNew production high and another 4 million barrels in the tanks. Keep on pumping as long as you can borrow the capital!

The net available capacity is how much total storage a tank has. But working storage capacity is the amount of oil that the tank can handle. Below the suction line, there's water and sediment, and oil that you can't suck out. For safety, there's normally a bit of contingency space at the top.

Here's more on working storage capacity, and why we need some of it to remain empty in order to have a functioning oil industry:

Working storage capacity, which excludes contingency space and tank bottoms, is perhaps a more useful measure of capacity. From September 2013 to September 2014, total crude oil working storage capacity increased from 502 million barrels to 521 million barrels. Operation of crude oil storage and transportation systems requires some amount of working storage to be available to be filled at all times in order to receive deliveries by pipeline, tanker, barge, and rail. Therefore, it is not possible to completely fill all the working storage capacity reported by EIA for the United States and PADD regions. The exact amount of storage capacity that must be available to maintain operation of crude oil storage and transportation systems is unknown.

The storage utilization rates reported above reflect crude oil inventories stored in tanks or in underground caverns at tank farms and refineries as a percentage of working storage capacity. Simply dividing the total commercial crude inventory by the working capacity can lead to overestimates of storage capacity utilization, because some inventory data include crude oil that is not truly in stored in tankage, such as:

Pipeline fill, or oil that is being transported by pipeline

Lease stocks, or oil that has been produced but not yet put into the primary supply chain

Crude oil on ships in transit from Alaska

"The exact amount of storage capacity that must be available to maintain operation of crude oil storage and transportation systems is unknown," the EIA said.

Comment

-

Also, it looks like ~$50s is where we might stay for a while:

On the low side:

Goldman Sachs: Just kidding about the $40/barrel

Goldman Sachs recently retracted low oil price forecasts for the next couple terms, Bloomberg reports. Having originally predicted prices floundering at $40 per barrel for the next two financial terms, the financial institute cited an underestimation in market health for their mistakenly grim predictions. “The lack of a meaningful build in the past few months leaves risk to our forecast for oil prices remaining at US $40 a barrel for two quarters skewed to the upside,” Goldman analyst Damien Courvalin said in the report. “Weather has played a great part in keeping crude off the market.”

The weather Courvalin referred to includes Sandstorms in Iraq, draughts in Brazil and unusually cold weather in the U.S., all of which fed into an increase in fuel consumption. Along with poor weather, violence in Iraq, Libya and Iran kept close to one million barrels per day from entering the market between January and February, according to Goldman.

And on the high side:

...its outlook through 2016 remains bearish because supply is set to increase.

Oil may not reach Goldman’s forecast of $65 a barrel in 2016 as U.S. producers have showed a faster-than-expected focus on financial discipline and “building an uncompleted well war chest,” according to the report.

Comment

-

Well I just read a depressing analysis. Here are the summary points I took away...

1. “the US rig count is now in free-fall even as US oil production increases. We note the change in production mirrors the change in activity with a lag of 1-2 years suggesting that US oil production will continue to increase in 2015 unless oil prices fall further and impact production.”

2. “The recent rig count history would suggest we might need no more than 300 gas-directed drilling rigs and no more than 500 oil-directed drilling rigs to maintain “flat” production.”

3. “do not expect oil to drive another near term cycle. Although the parallels between charts 2 and 3 are only anecdotal, they give us a reason to pause. Oil production declined with a rig count of 200 to 300 and held flat with a rig count of 300 to 400. While the rig count dropped each week in 2015, US oil production continues to increase. The historic lag between the rig count and production suggests that increasing production will continue throughout much of 2015. We do not know if, in aggregate, the oil wells drilled in the Bakken, Eagle Ford and Permian will show the slow decline rates associated with unconventional gas. If they do, a back of the envelope calculation might suggest that we will require no more than 500 rigs to offset the production decline and maintain production of 9-Mbpd.”

4.“absent another amazing technology story, we believe the US needs to hunker down for an extended period with activity below 1,000 rigs.”

Comment

-

Yes, you are only delaying the inevitable bust with cheap capital.Originally posted by Ruffdaddy View PostWould you advocate a shut in and the fast lane to bankruptcy?Originally posted by racrguyWhat's your beef with NPR, because their listeners are typically more informed than others?Originally posted by racrguyVoting is a constitutional right, overthrowing the government isn't.

Comment

-

Learned that Enable Midstream let go of 10% (200) of their people yesterday.

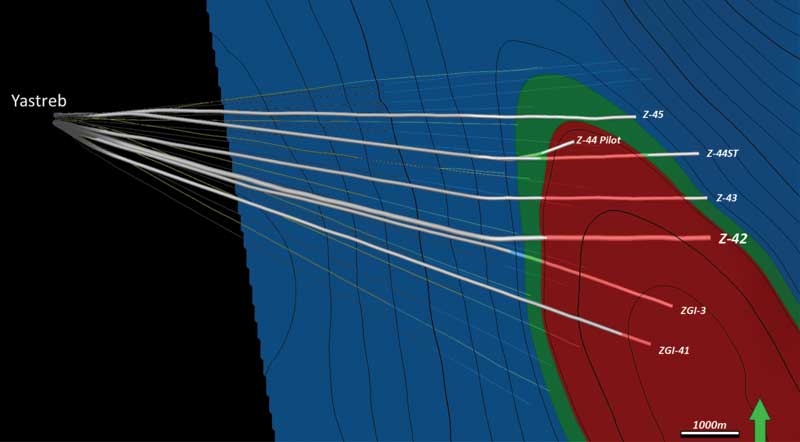

But in more positive news, a new world record was set by Parker Drilling on Sakhalin Island about 3 hours ago.

8,616 ft true vertical depth.

44,291 ft total depth (measured along borehole path)

That's a shitload of horizontal.

If you're not familiar with Sakhalin Island it's north of Japan on the east side of Siberia. Rigs there are jackups or land based rigs that drill out under the sea.

This record was with a land rig called Yastreb (The Hawk) which has set previous records here as well. In 2013 that rig owned 16 of the top ERD (extended reach drilling) records in the world.

Four 2200hp mud pumps, 1.3 million lb hook load capacity, 2200 hp top drive, 3000 hp drawworks, 14,000 barrels of liquidmud storage and six generators. Drill torque is 91,000 ft-lbs.

Last edited by Strychnine; 03-12-2015, 08:07 PM.

Last edited by Strychnine; 03-12-2015, 08:07 PM.

Comment

Comment