Originally posted by BP

View Post

Announcement

Collapse

No announcement yet.

Earned $17,493 - Anyone want to guess what her tax refund amount was?

Collapse

X

-

You want me to pay MORE in a pay period to those assholes?Originally posted by slow99 View PostA few periods into the year, take a pay stub and extrapolate the remainder of the year. Take projected income, deductions, exemptions, and use the tax tables to estimate what you'll owe. Compare that to the amount projected to be taken out of your checks and divide the remainder by the number of pay periods left in the year. Have your employer take out that amount as additional withholding each period. Of course, I'm not ballin' as hard as the rest of the board, but it works for me.

Comment

-

He asked how to break even.Originally posted by mstng86 View PostYou want me to pay MORE in a pay period to those assholes?Originally posted by davbrucasI want to like Slow99 since people I know say he's a good guy, but just about everything he posts is condescending and passive aggressive.

Most people I talk to have nothing but good things to say about you, but you sure come across as a condescending prick. Do you have an inferiority complex you've attempted to overcome through overachievement? Or were you fondled as a child?

You and slow99 should date. You both have passive aggressiveness down pat.

Comment

-

From Forbes.com

The credit has been around since 1975. It was intended to offset the burden of Social Security taxes – a chunk of your pay over and above federal income taxes – and to provide an incentive to work since the credit is only available to workers who earn money from wages, self employment or farm income. Critics, however, claim that it’s nothing more than a glorified subsidy. Other critics, like me, recognize that it’s one of the “easy targets” for abuse in the system. The IRS estimates an error rate of 23%-28% on EITC returns, or about $13 to $16 billion paid out in error. Yes, billion with a b.

Also read that the government pretty much loves it because it acts as an automatic stimulus for the economy each year.

Me and the wife have ours setup to get back around 25% of what we pay in

Comment

-

$15k in FICA?? Serious choooo$$$$ chooooo$$$$$$!Originally posted by 8mpg View PostGirl I worked with make $10-12/hr and with her 3 chilrens she got something like $9k last year.. Me on the other hand paid $15k in FICA and still owe another $500Originally posted by davbrucasI want to like Slow99 since people I know say he's a good guy, but just about everything he posts is condescending and passive aggressive.

Most people I talk to have nothing but good things to say about you, but you sure come across as a condescending prick. Do you have an inferiority complex you've attempted to overcome through overachievement? Or were you fondled as a child?

You and slow99 should date. You both have passive aggressiveness down pat.

Comment

-

The ease with which criminals have stolen the identities of taxpayers and received refunds has raised searing questions about how the IRS handles the citizenry’s most sensitive private information. It highlights the agency’s failings at what seems to be a basic task: verifying that a return is filed by a living and legitimate taxpayer. That failure has cost the federal government — and thus real taxpayers — billions of dollars.

The ease with which criminals have stolen the identities of taxpayers and received refunds has raised searing questions about how the IRS handles the citizenry’s most sensitive private information. It highlights the agency’s failings at what seems to be a basic task: verifying that a return is filed by a living and legitimate taxpayer. That failure has cost the federal government — and thus real taxpayers — billions of dollars.

These two 6th grade dropouts managed to get $2.2 million from the IRS over a 3 year period. It took 3 years and over $2 million dollars before the IRS figured it out, and even then the only reason anyone caught on to it was because someone threw a Jared style party.

I just got a letter today that last year's refund has been applied to the previous years over payment.

Comment

-

So you are saying you are a low wage employer, and force your employees to "game the system" so the rest of us can foot the bill?Originally posted by Sean88gt View PostYep. And there is a sweet-spot between $15k-24k when it pays to be a pile of shit. I had employees that would turn down paid vacation/use non-paid sick days/clock out and work because higher pay would thrust them out of their payday.

Comment

-

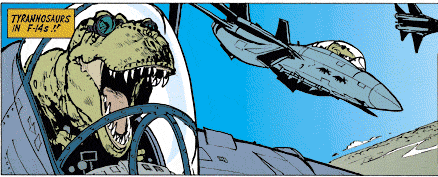

at science bitch.

at science bitch.

Comment